Procedure of refund requests

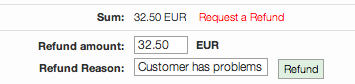

If a customer wants a refund, the operator has to decide whether the user is eligible to get a full or partial refund. In case the operator wants to give the money back to the user for an online transaction, the operator can request a transaction to be refunded from the Control Center, by searching for the transaction from the Reports > Transactions menu and click on the date of the transaction, then click on ‘Request a Refund’. A full or partial amount can be requested.

If the transaction was a cash transaction (Pre-Paid voucher), you have to deal with it and give the money back to the user if you decide to do so.

Understanding the Risks of Trading Online

The potential market for internet trading is vast and is a method of trading which any business would want to consider seriously. However, before you go online, you should ensure that you are aware of the risks involved in internet trading, your responsibilities and the measures you can implement to reduce the risk to your business.

So why is fraud such an issue?

Internet trading is regarded by the bodies which regulate credit and debit card trade as very similar to ordering goods by telephone or mail order because neither the cardholder nor the card are present when the order is placed. This means that there is no signature or a pin number that can be checked to confirm the identity of the cardholder and authenticity of the card making internet transactions particularly susceptible to certain types of fraud, even when a card has not been stolen. For example, a valid card number may be used without the consent of the cardholder, or the actual cardholder may claim that they did not receive the goods that were ordered, both of which could lead to the payment being disputed with the cardholder’s issuer and result in a chargeback.

Refunds vs Chargebacks

Customers can ask their money back via 2 ways: they can ask for a refund from the Operator (you) or directly from us (Hotspot System). You can decide to give the money back to the customer, you may choose to give partial refunds, or deny the refund. We’re providing all tools you need in the Control Center to help you decide easily, you can check whether the user could logged in or not, used the internet successfully or not, or had connection problems. If you decide to give the money back to the user partially or in full, you’ll have to tell us and we’ll make the necessary steps. If the customer asks the money back directly from us, then we’ll analyze our log files and decide whether the customer is eligible for the refund or not (we may ask the operator to decide this).

Chargebacks happen when a customer asks his/her bank to reverse the transaction, because of unauthorization, stolen card, or basically any reason. Then the bank starts the chargeback process by requiring information from us (proof of purchase, log files, etc), then the bank decides to give the money back to the customer or not.

Generally, chargebacks can occur up to six months after the transaction date, but this period can be extended in certain circumstances, such as where services are covered by a guarantee period, or where the period of delivery is uncertain (such as an ongoing contract for services). Ultimately, there is no guarantee that an authorised transaction may not prove fraudulent, and will not be charged back.

Fees of Refunds and Chargebacks

In case of a refund, we deduct the full amount from your account if the problem was not on our side (customer couldn’t connect, or had problems with the Wi-Fi signal, got interrupted service, etc). We only refund the service fee for the operator when the problem is related to the system itself. There is no additional fee of refunds.

When a chargeback happens, we deduct the full amount from your account, plus we deduct an additional chargeback fee which is 15 USD / 17.5 EUR / 10 GBP / 30 AUD / 35 NZD (depending on the currency of transaction).

We reserve the right to change these fees any time.