In some countries you can get your money via LOCAL bank transfer. The difference between this method and international wire transfer is that the incoming wire transfer will be from the same country (so there won’t be additional intermediate bank charges and your bank fees will be probably lower than if you get an international wire transfer).

How much does it cost to get my payout via local bank transfer?

HotspotSystem transfers the money for free.

Payoneer is currently charging:

– $5 setup fee (when you setup the account)

plus

– Regular local currency payment with (conversion): $2.99 (for example USD to US or EUR to a country within the EU)

– EUR wire in non-Euro countries: $9.95

– USD WIRE: $15 (USD to outside US)

Can you pay out in my local currency?

No, we will convert your payout to USD before sending your money to Payoneer. Payoneer always holds the balance in USD. Payoneer will do a currency conversion and sends a local bank transfer in your local currency.

What countries and currencies are supported?

Austria – EUR

Australia – AUD

Belgium – EUR

Bulgaria – EUR and BGN

Brazil – BRL

Canada – CAD

Cyprus – EUR

Czech Republic – CZK and EUR

Denmark – DKK and EUR

Estonia – EUR

Finland – EUR

France – EUR

Germany – EUR

Greece – EUR

India – USD and soon INR

Ireland – EUR

Israel – ILS

Italy – EUR

Japan – JPY

Latvia – LVL and EUR

Lithuania – EUR and LTL

Malaysia – MYR

Malta – EUR

Mexico – MXN

Netherlands – EUR

New Zealand – NZD

Norway – NOK and EUR

Philippines – PHP

Poland – PLN

Portugal – EUR

Romania – RON and EUR

Singapore – SGD

Slovakia – EUR

Slovenia – EUR

Spain – EUR

Sweden – EUR and SEK

Switzerland – EUR and CHF

Thailand – THB

Turkey – TRY

UK – GBP

United Arab Emirates – AED

What does the currency mean here?

It means that Payoneer will start the transfer in that currency so the currency conversion from USD to your local currency will be done by Payoneer and not your bank (Payoneer charges up to 3% on foreign currency or “cross border” transactions).

Should i choose this method over the international wire transfer?

This method is typically good for international operators who charge in USD or working with multi-currencies OR getting low amount of payouts from us monthly. You need to do a calculation for yourself whether to choose this method or not.

An example:

With International Wire Trasfer:

You charge in EUR > We pay you out in EUR and deduct 15 EUR for international wire transfer > your bank and other intermediate banks can also charge a fee – you need to check this! > you will receive the amount in EUR to your EUR bank account. TOTAL FEES: 15 EUR + other fees by your bank and other intermediate banks

With Local Bank Transfer:

You charge in EUR > We pay you out in USD (Payoneer always keeps the balance in USD) > Payoneer will convert the amount back to EUR and deduct $3 > you will receive the amount in EUR to your EUR bank account. TOTAL FEES: $3 + Conversion fees from EUR to USD + Conversion fees from USD to EUR

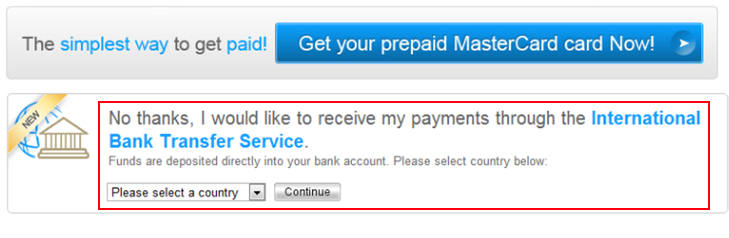

How can I choose this method?

- You need to fill out the application on Payoneer’s site. Go to the Control Center, click on Tools & Settings > Payout Info. Click on the Payoneer logo to go to Payoneer’s site.

- Sign up for Payoneer’s direct bank transfers (choose your country from the list)

- Your application will be reviewed by Payonner. Once approved you can switch to Payoneer in the Control Center as your payout method.

- Go to the Control Center > Tools & Settings > Payment Info > click on Payoneer and press ‘ Modify’. You can also set the payout limit to 100 USD or equivalent or above.